Learn about Magma / Aug 07, 2025

Building Trust in Tokenized Assets: What Magma Learned from RWA History

The RWA market has had its fair share of growing pains. RealT, once a big name in fractional real estate, is now being sued by the City of Detroit over fraud and mismanaged properties. Harbor, an early player in tokenized securities, was quietly shut down after getting acquired, leaving a lot of unanswered questions about transparency and longevity.

Add to that the Royal Mint Gold project, backed by the UK government, which folded after CME Group pulled out. Facebook’s Libra (later Diem) got buried under regulatory roadblocks, and now Unicoin’s facing heat over claims of misleading investors. These cases show one thing clearly: potential alone isn’t enough. Without solid regulation, smart execution, and real trust, this space can’t reach its promise.

The following content covers:

- Lessons from the Past — RWA Project Collapses & Setbacks

- Common Pitfalls — Governance, Transparency & Execution Gaps

- Introducing Magma — The Digital Twin Token (DTT®) Approach

- How Magma Mitigates Risk — Built-in Compliance & Real-World Ties

- Due Diligence — A Practical Checklist for Evaluating RWA Projects

- Looking Forward — Rebuilding Confidence in Tokenized Assets

Section 1. Industry Lessons

Lessons from the Past — RWA Project Collapses & Setbacks

Before diving into today’s innovations, it’s worth pausing and learning from past failures in the RWA space. These high-profile collapses and setbacks remind us that even the most ambitious RWA projects can fall apart without legal clarity, strong compliance, and real asset backing.

- RealT (2025)

Sold tokens for 39 homes it allegedly didn’t own. Raised ~$2.72M. Detroit sued over 400+ properties for code and tax violations. Tenants faced poor living conditions and unclear management.

- Harbor (2018)

Tried to tokenize a $20M student housing asset. The project failed after the lender blocked it due to legal conflicts with mortgage terms. - Royal Mint Gold (2016–17)

Planned to tokenize $1B in gold with CME. The UK Treasury blocked it, and the project was shut down before launch. - Libra / Diem (2019–2022)

Facebook’s stablecoin project was shut down after global regulatory pushback. Even insiders called it a “100% political kill.”” - Unicoin (2025)

SEC sued Unicoin for misleading investors. Claimed $680M in land value (real value ~$40M), sold certificates for a token that never launched.

Section 2. Recurring Challenges

Common Pitfalls — Governance, Transparency & Execution GapsAs real-world asset (RWA) tokenization grows, certain recurring issues keep resurfacing. Most failures stem from weak legal frameworks, lack of transparency, and poor execution. Here’s how these challenges have played out:

1. Blurred accountability and legal gaps

In RealT’s Detroit case, over 400 properties were neglected through a web of shell companies. The city filed a major blight lawsuit targeting RealT and its founders for code violations, unpaid taxes, and unsafe living conditions.

Lesson: Without clear legal ownership, token structures can obscure responsibility rather than enforce it.2. Token claims without verified ownership

RealT allegedly sold tokens for 39 homes it didn’t own, raising around $2.72M, Tenants were left with eviction threats, no heating, mold issues, and unreachable landlords.

Lesson: Tokens mean little if asset ownership isn’t legally clear and enforceable.3. Financial and legal incompatibility

Harbor tried to tokenize a $20M student housing asset, but the project collapsed when its lender blocked the move due to legal conflicts in mortgage terms.

Lesson: RWA structures must work within the boundaries of traditional finance and legal systems.4. Regulatory resistance

The Royal Mint Gold project, aiming to tokenize $1B in gold with CME, was halted by the UK government over reputational and regulatory concerns.

Lesson: Even well-partnered projects can fail without firm regulatory alignment.5. Tech isn’t a replacement for execution

While RealT used blockchain to manage rent and token transfers, it failed on the basics: taxes went unpaid, violations piled up, and tenants suffered.

Lesson: Blockchain can’t substitute for solid legal clarity, operational control, and ethical asset management

True RWA progress requires more than tokenization—it demands discipline, transparency, and real-world readiness.

Section 3. A New Approach

Introducing Magma — The Digital Twin Token (DTT®) Approach

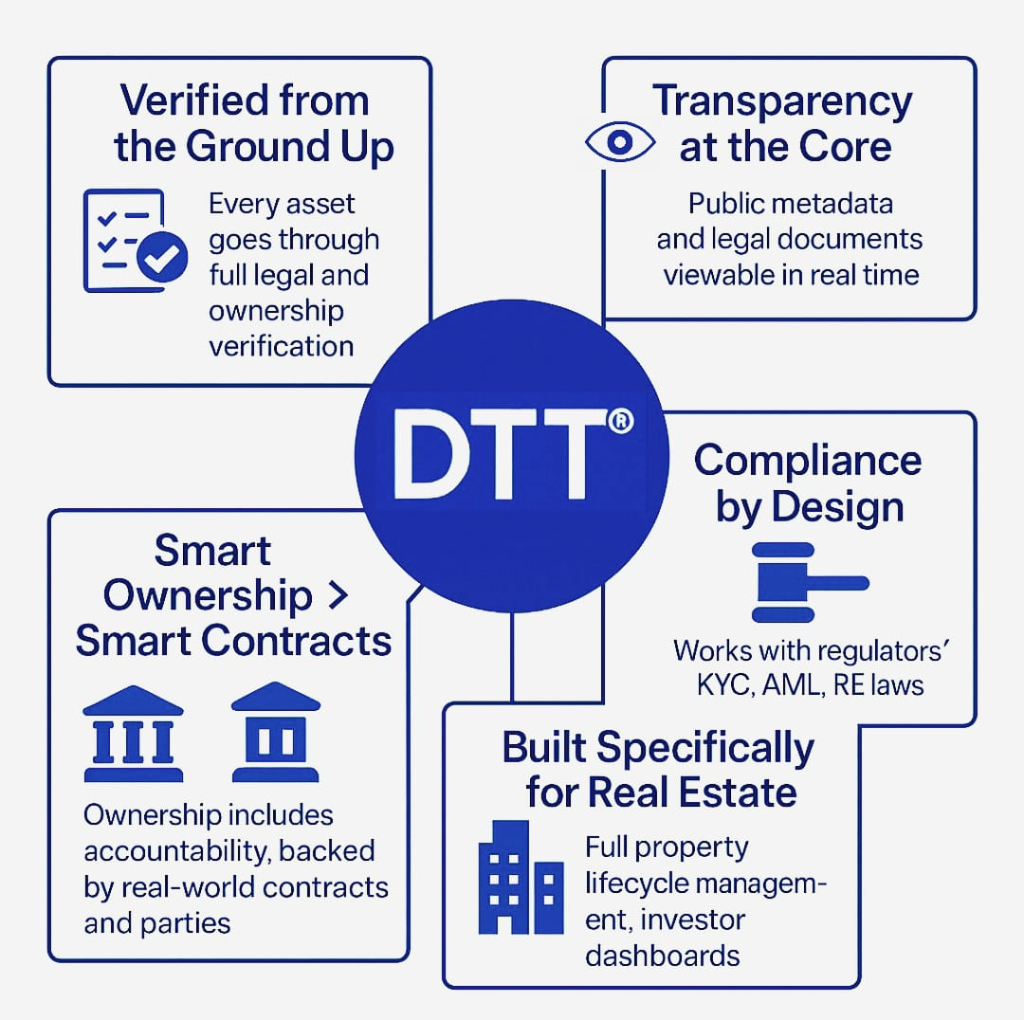

After years of trial and error in the RWA space, one thing is clear: tokenizing real-world assets is more than just putting properties on the blockchain. It’s about creating trust, clarity, and enforceability in a space that has lacked all three. That’s where Magma comes in, not just with a new platform, but with a smarter, more grounded approach.

1. From paper to digital — every asset starts with a verified twin

Most RWA failures begin with poor ownership verification. RealT allegedly sold tokens for homes it didn’t even own. With Magma, that kind of mistake is impossible by design. Each asset onboarded is first turned into a Digital Twin Token (DTT®), a cryptographic representation that mirrors the verified legal rights, documents, and data of the real asset.Real-world example:

Think of a commercial building in London. Magma ensures that every document title deed, compliance report, tenant contracts is verified and legally backed before a DTT is ever created. So what you’re buying or interacting with isn’t a promise, it’s a proven asset.2. Transparency baked in — not an afterthought

Many projects hide behind complex corporate structures or offered no way to trace token legitimacy. Magma flips that. Every DTT® is traceable, timestamped, and embedded with real legal metadata. You can literally see the paperwork in real time.So instead of “just trust us”, it’s “here’s the proof.”

3. Designed for compliance — not just code

Harbor’s failure proved that you can’t bypass legacy finance and legal systems. Magma works with them, not against them. Whether its regulatory licenses, KYC, or regional real estate laws, the platform is designed to integrate with compliance, not treat it as an afterthought.

This means fewer nasty surprises from regulators, lenders, or local authorities.4. Smart ownership, not just smart contracts

Many platforms thought blockchain alone could solve everything. But what happens when tenants can’t reach the landlord? Or the city sues for unpaid taxes?Magma’s structure ensures that ownership isn’t just token-based, it’s accountable. Each DTT® ties back to a responsible party, with verified legal agreements and real-world enforcement behind the scenes. No more ghost landlords or shell companies.

5. Built for real estate, not just crypto

Instead of general-purpose token platforms, Magma is purpose-built for real estate.That includes:- Support for property lifecycle management (from due diligence to tenant onboarding)

- Embedded reporting dashboards for investors and asset managers

- Custom roles for landlords, tenants, brokers, and legal reps

In short: this isn’t “DeFi for real estate.” This is real estate, made digital.

Why this matters:

Every failed project we discussed earlier had one thing in common: a disconnect between digital ambition and real-world execution. Magma’s DTT® model bridges that gap. By anchoring digital assets in legal reality, building transparency into the core, and respecting the complexity of real estate, it offers a path forward.Not just another token. A better foundation for the entire RWA ecosystem.

Section 4. Built to Last

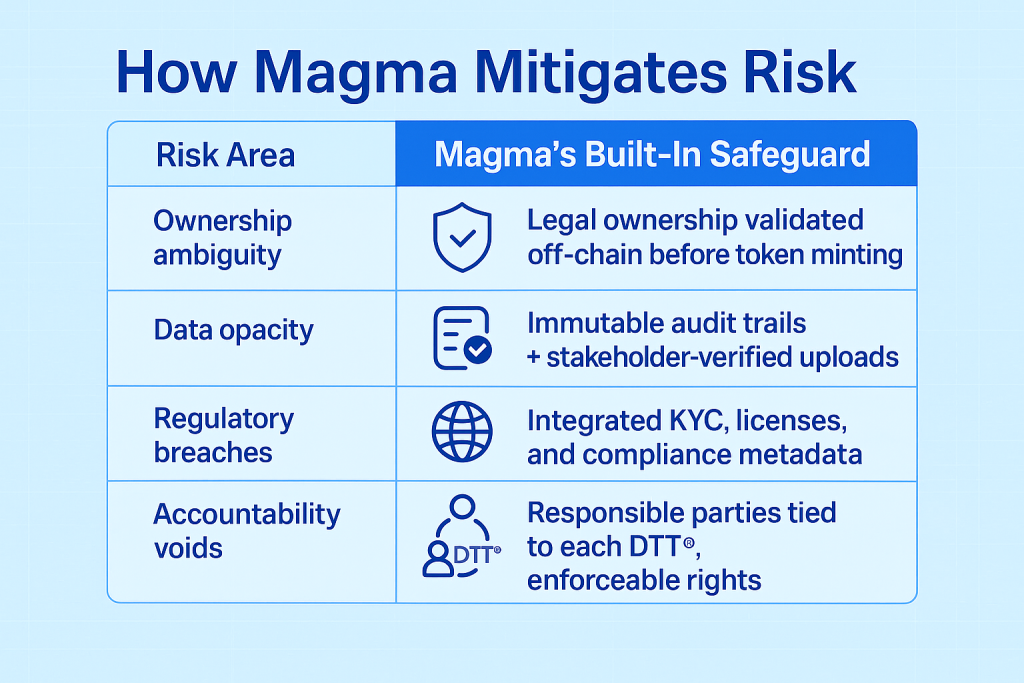

How Magma Mitigates Risk — Built‑in Compliance & Real‑World TiesMagma levels up where past projects failed, by fusing token tech with legal, operational, and data integrity from day one.

Verified Data from Day One

Every building-upload to Magma starts with a rigorous data-validation protocol. Stakeholders, owners, managers, service providers upload documents and perform verifications tied directly to the property. That includes ownership titles, compliance certificates, tenant contracts, and systems data from BIM or BMS. Only validated information enters the Digital Twin Token (DTT®)

Transparent Governance & Traceability

With Magma, transparency isn’t optional—it’s mandatory. Every contribution, every transaction, every change is time-stamped, traceable, and tamper-resistant on-chain. That means you can audit who uploaded what, how metadata evolved, and whether changes relate to building rules or legal obligations

Compliance Embedded, Not Add‑On

Magma was designed with compliance baked in, not bolted on. It supports KYC flows, regulatory alignment, and local real estate laws. Legal documents are embedded into the DTT® so the token reflects enforceable agreements, not just digital claims. This approach protects against surprises like lender blockages, investor disputes, or local authority pushback

Accountability & Real‑World Enforcement

Unlike projects that disappear when trouble strikes, each DTT® is tied to defined responsible stakeholders. That means landlords, managers, or service providers remain legally reachable. Magma ensures ownership isn’t ghostly tokenization, but legally anchored accountability, backed by real enforcement paths.

Asset Intelligence & Lifecycle Control

Magma’s DTT® is a living model:

- It includes a 3D digital twin, enriched with real asset metadata and IoT data feeds.

- AI-powered dashboards monitor building performance, energy usage, predictive maintenance, ESG metrics, and transaction activity.

- This ensures the asset stays performance-ready, compliant, and transparent across its lifecycle

Institutional Momentum & Ecosystem Alignment

Through partnerships: like Magma’s recent integration with Zoniqx, assets represented by Magma’s DTT® can flow into compliant, multi‑chain distribution frameworks. That opens access to institutional investors, automated yield tools, and regulated secondary markets while maintaining data integrity and legal backing at the core

Magma doesn’t just tokenize buildings, it embeds them with the legal, operational, and data foundations needed to last. DTT® is more than a digital claim, it’s a proven, trackable, and enforceable bridge between property and blockchain.

Section 5: Looking Ahead

How We Rebuild Trust in Tokenized AssetsLet’s be honest: the RWA space has taken a few hits. Projects overpromised, underdelivered, and in some cases, didn’t even own the assets they were selling.

So how do we move forward?

We stop treating tokenization like a shortcut and start building it the right way. That’s exactly what Magma is doing with it’s Digital Twin Token (DTT®) model.

Every asset, verified before it’s tokenized

No more “trust us” vibes. Magma doesn’t create a token unless the legal paperwork is fully checked and approved. That means ownership is real, not theoretical.

Transparency you can actually see

Instead of hiding contracts and compliance docs behind closed doors, Magma makes them accessible — timestamped and embedded right in the token. If you want to see the history of a property, it’s all there. No digging required.

Built with compliance in mind

Magma doesn’t fight regulation, it works with it. From KYC to regional real estate rules, the platform is designed to play by the book. So there are fewer surprises down the line, for everyone involved.

Real ownership, not just a token

A lot of projects made the mistake of thinking token = ownership. But what happens when things go wrong? Magma ties every DTT to someone actually responsible for the property, with the right legal agreements in place.

Made for real estate — not just crypto people

This isn’t another DeFi experiment. Magma is built for real estate professionals, investors, and property managers. Everything from onboarding assets to tracking performance is tailored for real-world use.

The Bottom Line?

People don’t want more promises. They want something they can trust. Magma’s DTT® model brings tokenization back down to earth — making it clear, compliant, and connected to reality.

That’s how we rebuild confidence. Not with noise. With proof.